Shane’s Market Insights: Why Our Local Real Estate Market Bucks the National Trends

As a real estate broker, whenever you run into a friend around town, after they ask you how you are doing the next question is, “How’s the market?” Since January sales are usually slow, I thought it would be more interesting for me to share some analysis of how our local real estate market behaves compared to the national and even Treasure Valley markets.

The national reports are buzzing right now with predictions about what 2024 will bring. Most experts say a change is in sight. But those who’ve been waiting for a market turnaround want to know…when? This recent article in Newsweek calls out the main factor that makes OUR market an outlier:

“Rates have been declining over the last few weeks and are now in the mid-6 percent range. And with a robust economy plus higher wages that Americans are seeing, the market will likely see a shift over the coming months,” according to Mark Zandi, chief economist at Moody’s Analytics. “The sticking point as to how fast the market rebounds hinges on prices.”

So when will prices start falling HERE?

The McCall area generally trails behind the trends you find in the Treasure Valley. For instance, when prices started to rebound from the Great Recession in the Boise area, we didn’t see the same increase in value until about 20 – 24 months after they did. When prices started to dip in the fall of 2022 across all of Idaho, we didn’t see the same drop until mid-2023.

As of this writing, the West Central Mountains have not experienced the same decrease in value as the Treasure Valley has.

There are a few reasons why. One, our area is unique, and we do have scarcity when it comes to lakefront, riverfront, larger parcels, etc. so this tends to drive prices higher. This is the basic principle of supply and demand. Two, buyers don’t NEED a second home, it is a luxury and they can wait and be patient when it comes to buying. You wouldn’t believe how many times our buyers tells us, “We are not in a hurry.” And the third factor is on the seller’s side. Once again, two out of three properties in our area are NOT a primary residence or are investment properties. That means most sellers are not in a panic to sell, again, not in a hurry, so they can “wait” until they get the price they want.

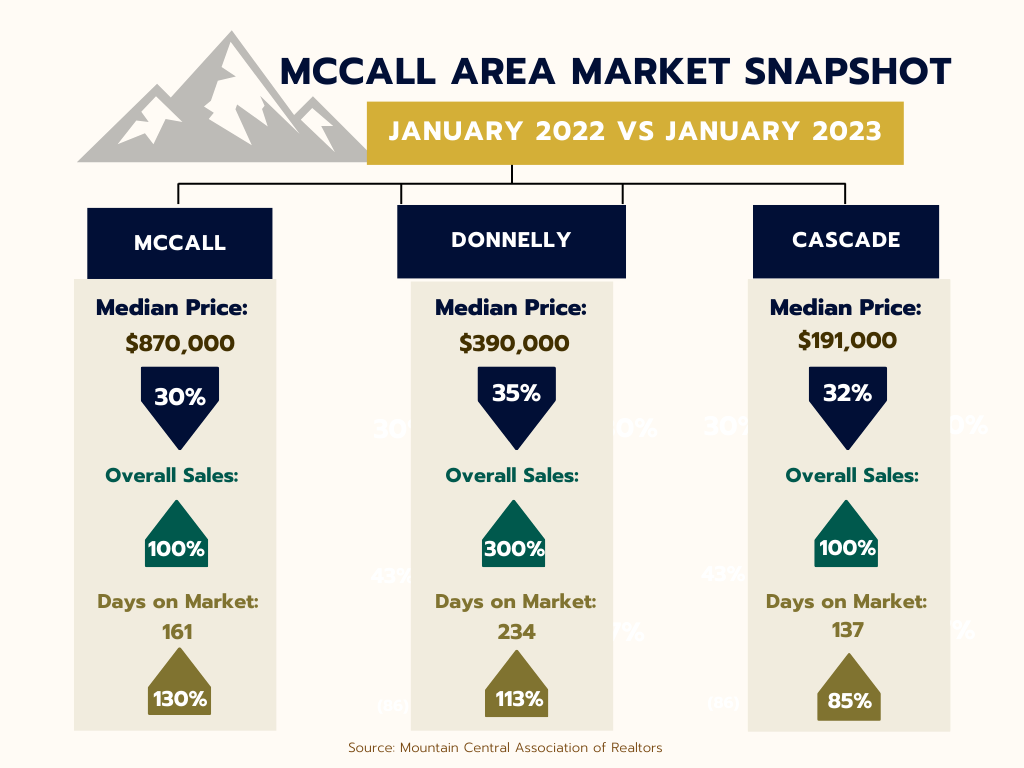

Keep in mind when looking at the January numbers that volumes are EXTREMELY low this time of year, so we may not be able to identify “trends” until we hit spring listing season. In fact, there’s not enough data to compile our Meadows Valley stats this month, so we’ve left those off for the time being. Here are the numbers for the rest of the local area:

I do see some good news when I look at these figures. The number of units sold is trending up. On the flip side, prices are slipping and days on market (DOM) are up considerably. There is still optimism that the Fed will lower rates that will become more attractive to buyers. I’ll continue to follow these trends closely and give you monthly updates on where our market stands compared to the markets that pop up frequently in the news reports.

If you have specific questions, don’t hesitate to reach out!