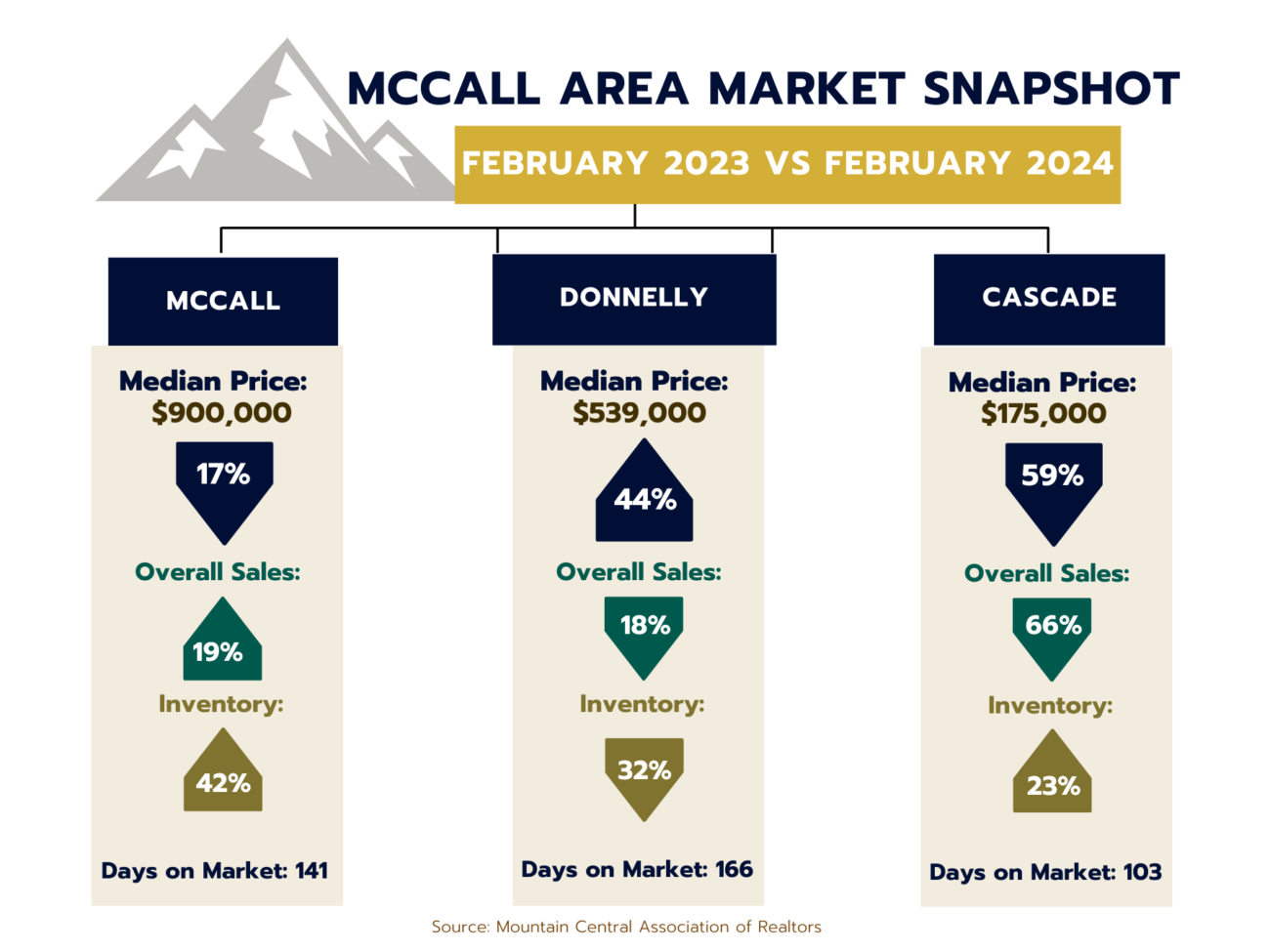

Winter is generally a slow time for real estate transactions in our area, and it may be a bit too early to identify any lasting trends, HOWEVER, the local market does seem to be trending toward more inventory and more days on market.

We have gone from a 5-month supply of inventory in 2023 to a 6.5-month supply. That means there are more homes on the market, and listed homes are generally taking longer to sell. (Please note: there is not enough data this month to include Meadows Valley statistics).

Overall, we are still trending towards a buyers’ market. March should be an even better indicator of how much inventory will hit the market this Spring/Summer as we start to gear up with new listings.

What does this mean for sellers? Pricing your home or property correctly and competitively will be CRUCIAL if you want your property sold.

TIPS FOR SELLERS:

- Research comparable home prices in the area. Sellers need to have the most up-to-date pricing on comparable homes that are selling (versus list prices). Understand that at some price points it’s a buyers market, and you may need to be prepared to make some concessions.

- Make sure your home is in top-notch shape.Homes need to be in great condition to compete. Well-maintained homes and attractive front yards are major features that buyers look for.

- Don’t put off issues that require attention.Prepare the home by making any repairs or improvements. Removing any objections that buyers may see helps focus the buyer on the positive attributes of the home.

- Work with a local real estate agent.A real estate agent or team with a strong local marketing presence can offer significant value and help you land a great deal. (And price your home competitively to begin with).

TIPS FOR BUYERS:

- Know your budget.Instead of focusing on price, figure out how much you can afford as a monthly payment. Your monthly housing payment is influenced by the price of the home, your down payment, mortgage rate, loan term, home insurance and property taxes.

- Be flexible about home size and location. Perhaps your budget is sufficient for a small home in your perfect neighborhood, or a larger, newer home further out. Understanding your priorities and having some flexibility can help you move quickly when a suitable home hits the market.

- Keep an eye on the market where you hope to buy. Determine the area’s available inventory and price levels. Also, pay attention to how quickly homes sell. Not only will you be tuned in when something great hits the market, you can feel more confident moving forward with purchasing a well-priced home. This is where an experienced real estate agent can REALLY help.

- Don’t be discouraged. Purchasing a home is one of the largest financial decisions you’ll ever make. Approaching the market confidently, armed with good information and grounded expectations will take you far. Don’t let the hustle of the market convince you to buy something that’s not in your budget, or not right for your lifestyle.