Shane’s Market Insights

November is here and that means we’re gearing up for winter. Locals are dodging small snow events while making sure they’ve got their wood piles replenished and outdoor areas tidied up. At the same time – we’re starting to watch that forecast for the big storms that transform this beautiful place into a winter recreation hub.

If this is your first winter in the mountains, you’ll want to get a move on in preparing for winter. Here are 10 Handy Tips on how to winterize your home.

If you’re looking to buy or sell during the winter months, the persistent blanket of snow can present unique challenges. That’s why it’s important to have an experienced, local agent who can help you navigate this process and deliver top value during your real estate quest.

As one can imagine, the winter months normally show a big drop in sales. Most lots are pulled off the market and residential sellers who don’t come up in the winter don’t want to deal with the snow while trying to move.

What Does That Mean for Sellers?

This can be a good time to list if you do keep your driveway plowed because there is less inventory to compete with. And showing a home with a fresh dusting of snow on the ground can present buyers with an idyllic image.

A lot of people think of McCall as a summer getaway, but there are a lot of potential buyers that come up here because of the winter activities, so there is definitely a niche market of buyers that weren’t looking at the broader selection of summer listings.

What About the Buyers?

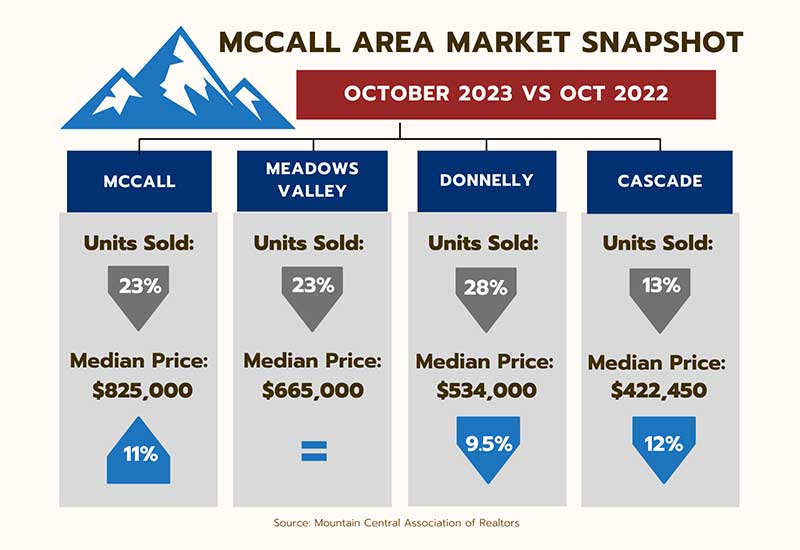

In addition to the softening of prices (outside of McCall, at least) there is another sign of hope for buyers: Mortgage rates saw the biggest one-week drop in over a year last week, causing the first increase in mortgage demand in a month.

According to the Mortgage Bankers Association’s seasonally adjusted index, total mortgage application volume rose 2.5% last week, compared with the previous week. The average contract interest rate for a 30-year fixed-rate mortgage dropped from 7.86% to 7.61%. Those rates are still high compared to 2020 and 2021 when we saw rates dip below 3%, but some are encouraged to see rates go down instead of staying on the upward trajectory we’ve seen for so long.